On March 7th, US Customs and Border Protection (CBP) released direction regarding steel and aluminum tariffs that will become effective March 12, 2025.

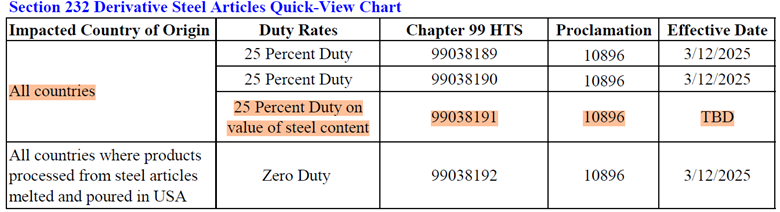

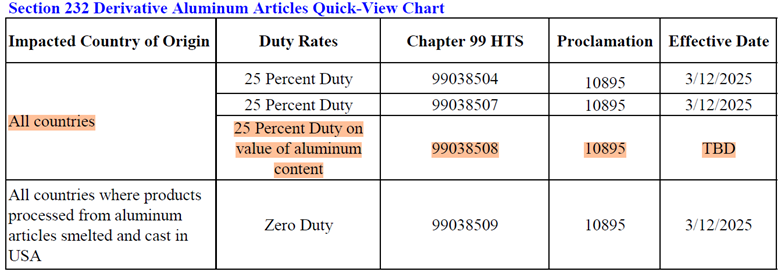

The following guidance applies to some steel and aluminum derivative articles subject to an additional 25% or as announced today, potentially 50% duty. The tariff will still only apply to the steel or aluminum content, however, the start date for those derivative articles outside of chapters 73 and 76 is yet to be determined.

CBP issued CSMS messages, available at the links below, which indicate effective dates for the steel and aluminum derivative articles outside of Chapters 73 and 76, will be certified by the Secretary of Commerce in the Federal Register.

Effective with respect to aluminum articles and derivative aluminum articles entered for consumption, or withdrawn from warehouse for consumption, on or after a date to be certified in the Federal Register by the Secretary of Commerce, the following HTS classification and 25 percent duty rate applies:

- 9903.85.08: Derivative aluminum products listed in subdivision (k) (new aluminum derivative articles not classified in Chapter 76 subject to Section 232): the import duty is based upon the value of the aluminum content.

Effective with respect to steel articles and derivative steel articles entered for consumption, or withdrawn from warehouse for consumption, on or after a date to be certified in the Federal Register by the Secretary of Commerce, the following HTS classification and 25 percent duty rate applies to the value of the steel content:

- 9903.81.91: Derivative iron or steel products listed in subdivision (n) (new steel derivative articles not classified in Chapter 73 subject to Section 232): the import duty is on the value of the steel content.

CSMS # 64348411 – GUIDANCE: Import Duties on Imports of Steel and Steel Derivative Products

CSMS # 64348288 – GUIDANCE: Import Duties on Imports of Aluminum and Aluminum Derivative Products

Below is a complete list of derivative HTS numbers that will NOT have a March 12, 2025 effective date.

Iron or steel: 8431.31.00; 8431.42.00; 8431.49.10; 8431.49.90; 8432.10.00; 8432.90.00; 8547.90.00; 9403.20.00; 9405.99.20; 9405.99.40; 9406.20.00; 9406.90.01.

Aluminum: 6603.90.8100; 8302.10.3000; 8302.10.6030; 8302.10.6060; 8302.10.6090; 8302.20.0000; 8302.30.3010; 8302.30.3060; 8302.41.3000; 8302.41.6015; 8302.41.6045; 8302.41.6050; 8302.41.6080; 8302.42.3010; 8302.42.3015; 8302.42.3065; 8302.49.6035; 8302.49.6045; 8302.49.6055; 8302.49.6085; 8302.50.0000; 8302.60.3000; 8302.60.9000; 8305.10.0050; 8306.30.0000; 8414.59.6590; 8415.90.8025; 8415.90.8045; 8415.90.8085; 8418.99.8005; 8418.99.8050; 8418.99.8060; 8419.50.5000; 8419.90.1000; 8422.90.0640; 8424.90.9080; 8473.30.2000; 8473.30.5100; 8479.89.9599; 8479.90.8500; 8479.90.9596 8481.90.9060; 8481.90.9085; 8486.90.0000; 8487.90.0080; 8503.00.9520; 8508.70.0000; 8513.90.2000; 8515.90.2000; 8516.90.5000; 8516.90.8050; 8517.71.0000; 8517.79.0000; 8529.90.7300; 8529.90.9760; 8536.90.8585; 8538.10.0000; 8541.90.0000; 8543.90.8885; 8547.90.0020; 8547.90.0030; 8547.90.0040; 8708.10.3050; 8708.10.60; 8708.29.5160; 8708.80.6590; 8708.99.6890; 8716.80.5010; 8807.30.0060; 9013.90.8000; 9031.90.9195; 9401.99.9081; 9403.10.00; 9403.20.00; 9403.99.1040; 9403.99.9010; 9403.99.9015; 9403.99.9020; 9403.99.9040; 9403.99.9045; 9405.99.4020; 9506.11.4080; 9506.51.4000; 9506.51.6000; 9506.59.4040; 9506.70.2090; 9506.91.0010; 9506.91.0020; 9506.91.0030; 9506.99.0510; 9506.99.0520; 9506.99.0530; 9506.99.1500; 9506.99.2000; 9506.99.2580; 9506.99.2800; 9506.99.5500; 9506.99.6080; 9507.30.2000; 9507.30.4000; 9507.30.6000; 9507.30.8000; 9507.90.6000; 9603.90.8050.

Please contact our US regulatory group with any concerns/questions.