On March 7th, US Customs and Border Protection (CBP) released direction regarding steel and aluminum tariffs that will become effective March 12, 2025.

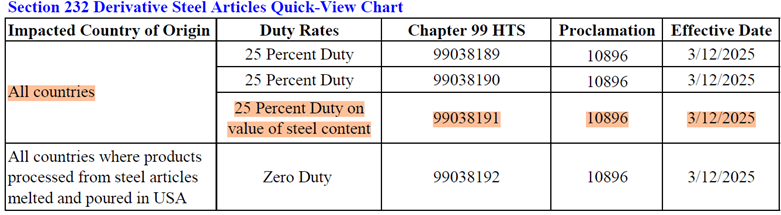

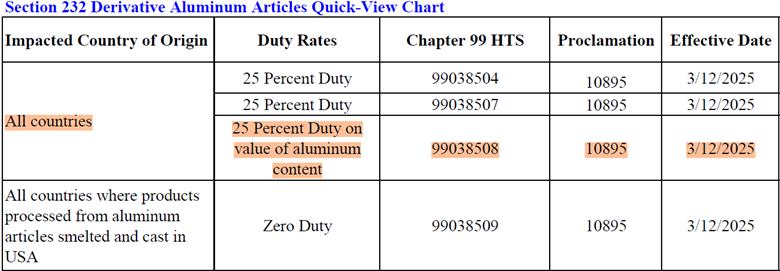

The following guidance applies to steel and aluminum derivative articles subject to an additional 25% or as announced today. The tariff will still apply to the steel or aluminum content AND those derivative articles outside of chapters 73 and 76. The Secretary of Commerce has certified that adequate systems are in place to process and collect tariffs on derivative articles.

For steel and aluminum derivatives outside of chapter 73 and chapter 76, the tariff will apply only to the steel or aluminum content. If the value of the steel or aluminum content is unknown, the duty will be based on the entire entered value.

For reporting purposes, a breakout of the steel and aluminum content by weight (kg) and value for each item will need to be provided on the commercial invoice by line.

If items listed on the annex for derivatives does not include any content of steel or aluminum, Willson recommends adding the statement “NO STEEL OR ALUMINUM DERIVATIVES” to your commercial invoice.

Please note that the exemption from the 25% duties if you use U.S. melt/pour steel or U.S. smelt/cast aluminum only applies to the NEW derivatives. It is unclear if the exemption will eventually be extended to the original products and original derivatives.

In the case where the value of the steel content is less than the entered value of the imported article, the good must be reported on two lines. The first line will represent the non-steel content while the second line will represent the steel content. Each line should be reported in accordance with the instructions below.

Non-Steel content, first line:

- Ch 1-97 HTS

- Country of origin

- Total entered value of the article less the value of steel content.

- Report the total quantity of the imported goods.

Steel content, second line:

- Same Ch. 1-97

- Country of origin

- Report the value of steel content.

- Report a second quantity (of the steel content) in kilograms

Additional Steel requirements: Melt and Pour Reporting

The reporting of the country of melt and pour and applicability code is mandatory for both steel and derivatives thereof. To report the country of melt and pour, importers must report the International Organization for Standardization (ISO) code on steel articles and derivative steel articles subject to Section 232. For steel articles, importers must report the ISO code where the steel was originally melted and poured. For steel derivatives, importers must report the ISO code where the steel was originally melted or “OTH” (for other countries). For products melted and poured in the United States, importers must indicate “US” as the country of melt and pour.

Additional Aluminum requirements: Smelt and Cast Reporting Requirements

To report the primary country of smelt, secondary country of smelt, or country of most recent cast importers must report the International Organization for Standardization (ISO) code on aluminum articles and derivative aluminum articles on all countries subject to section 232.

Filers must report “Y” for primary country of smelt; and/or secondary country of smelt. Filers may not report “N” for both primary country of smelt and secondary country of smelt.

If the imported aluminum is manufactured only from recycled aluminum, then filers should report “Y” for the secondary country of smelt, and report the country reported as the country of origin of the imported article as the secondary country of smelt code. Take note that aluminum manufactured only from recycled aluminum is not very common. Importers must be able to provide manufacturing documents, upon request, to substantiate the manufacturing process for the recycled aluminum product.

Country of Origin United States is not covered by the countries of smelt and cast reporting requirements. If the imported product was smelted and cast in the United States, then the importer will report “US” for the country of smelt and “US” for the country of cast.

CSMS # 64384423 – UPDATED GUIDANCE: Import Duties on Imports of Steel and Steel Derivative Products

Please contact our US regulatory group with any concerns/questions.